The lithium market is buzzing, and for good reason. As the backbone of electric vehicle batteries and renewable energy storage, lithium has become a hot topic in investing. If you’ve been following 5StarsStocks.com, you know they’ve been diving deep into 5StarsStocks.com lithium stocks, offering insights and strategies for investors. In this article, we’ll break down the key points you need to know about lithium stocks and how 5StarsStocks.com evaluates them.

Understanding the Lithium Market Landscape

Key Players in the Lithium Industry

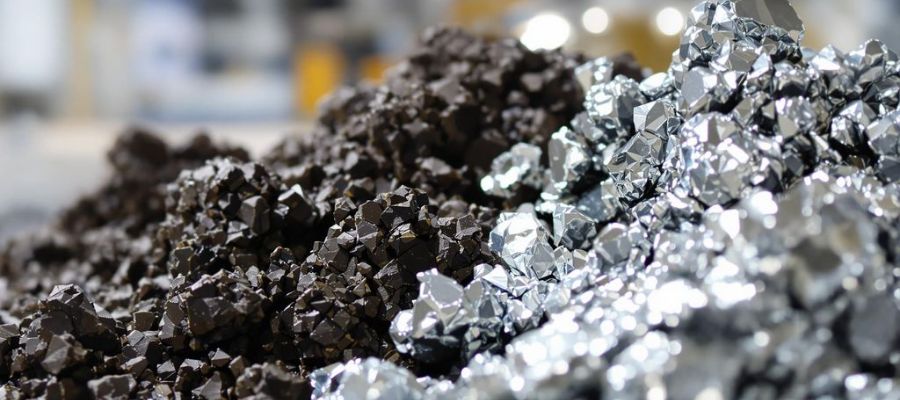

The lithium industry is dominated by a handful of major companies, each playing a significant role in the global supply chain. Albemarle Corporation, SQM, and Ganfeng Lithium are among the most prominent names, controlling a large portion of lithium production and processing. These companies are often vertically integrated, meaning they handle everything from mining to refining, ensuring consistent supply. Smaller players, while less dominant, have been growing rapidly, particularly in regions like Australia and South America.

Global Demand Trends for Lithium

The demand for lithium has been skyrocketing, largely due to its critical role in the production of batteries for electric vehicles (EVs). With EV adoption accelerating worldwide, lithium has become a cornerstone resource. Beyond EVs, lithium is also essential for renewable energy storage and various consumer electronics. Analysts predict that global lithium demand could double or even triple by 2030, driven by advancements in technology and government incentives for green energy.

Impact of Lithium Prices on Stock Performance

Lithium prices are notoriously volatile, and this directly affects the performance of lithium-related stocks. When prices are high, companies see improved profit margins, often leading to stock price surges. Conversely, falling lithium prices can squeeze margins, impacting investor confidence. For instance, a drop in lithium prices in late 2024 led to mixed earnings for some major producers. Investors should closely monitor price trends and cost structures to understand potential risks and opportunities.

5StarsStocks.com Lithium Stock Insights

How 5StarsStocks.com Evaluates Lithium Stocks

When it comes to analyzing lithium stocks, 5StarsStocks.com lithium experts focus on a mix of financial metrics, industry trends, and company-specific performance. Their evaluation process often includes:

- Assessing revenue growth tied to lithium production.

- Reviewing operational efficiency, including cost management.

- Monitoring market share and expansion into new regions.

This structured approach helps investors pinpoint stocks with potential for stable returns.

Top Lithium Stocks Highlighted by 5StarsStocks.com

The platform frequently highlights standout performers in the lithium sector. A typical list might include:

| Stock Name | Market Cap (in billions) | Recent Performance |

|---|---|---|

| Albemarle Corp. | $26 | Steady growth |

| SQM | $18 | Moderate gains |

| Livent Corp. | $6 | Strong potential |

These companies have been recognized for their ability to adapt to fluctuating lithium prices and maintain profitability.

Investment Strategies for Lithium Stocks

Investing in lithium stocks can be tricky, but 5StarsStocks.com lithium analysts suggest these strategies:

- Diversify: Don’t put all your money into one stock—spread it across multiple companies.

- Timing: Pay attention to global demand cycles and lithium price trends.

- Long-term focus: Lithium demand is expected to grow with the rise of electric vehicles and renewable energy storage.

“Investing in lithium stocks isn’t just about picking the biggest player—it’s about understanding the market dynamics and aligning them with your goals.”

Analyzing Lithium Stock Performance

Recent Earnings Reports of Major Lithium Companies

The latest earnings season has offered a mixed bag for lithium companies. Albemarle, for instance, managed to boost profits despite lower lithium prices, thanks to aggressive cost-cutting measures. This highlights how operational efficiency can offset market downturns. Other players like Livent and SQM have reported varying results, with some benefiting from long-term contracts that shielded them from price volatility. Here’s a quick snapshot:

| Company | Key Highlight | Date |

|---|---|---|

| Albemarle | Cost reduction drove profit growth | Feb 13, 2025 |

| Livent | Stable revenue from fixed contracts | Feb 10, 2025 |

| SQM | Decline in earnings due to prices | Feb 8, 2025 |

Factors Driving Profitability in the Lithium Sector

Several factors play into profitability for lithium producers:

- Lithium Prices: High prices generally boost margins, but volatility can hurt.

- Operational Costs: Companies with efficient operations tend to weather downturns better.

- Market Demand: Increasing EV sales and battery storage needs drive demand.

Companies that can balance these elements often emerge as leaders in the sector.

Challenges Facing Lithium Producers

While the lithium market has immense potential, it is not without its hurdles:

- Price Volatility: Fluctuating lithium prices can disrupt revenue streams.

- Environmental Concerns: Mining operations often face scrutiny over their ecological impacts.

- Supply Chain Issues: Delays in raw material delivery can hinder production.

Also Read: 5StarsStocks.com Nickel: Top Investment Insights and Market Trends

Future Prospects for Lithium Investments

Emerging Technologies Boosting Lithium Demand

The rise of electric vehicles (EVs) and renewable energy storage systems continues to drive demand for lithium. Battery innovations, like solid-state technology, are expected to revolutionize the industry, making lithium even more critical. Additionally, the growing adoption of smart devices and grid-scale energy storage solutions further amplifies the need for lithium.

Government Policies Supporting Lithium Mining

Governments worldwide are stepping up to support lithium production. Policies promoting green energy transitions often include subsidies or incentives for lithium mining and processing. For instance:

- Tax breaks for companies investing in lithium extraction.

- Grants for research into sustainable mining practices.

- Streamlined permitting processes to accelerate new projects.

Long-Term Growth Projections for Lithium Stocks

The future of lithium investments looks bright, with analysts forecasting steady growth in the sector. A quick snapshot:

| Metric | 2025 Projection | 2030 Projection |

|---|---|---|

| Global Lithium Demand | 1.5M tons | 3.2M tons |

| EV Market Share (global) | 40% | 60% |

| Lithium Stock Index Growth | +8% annually | +10% annually |

Risks and Opportunities in Lithium Stocks

Market Volatility and Lithium Prices

Lithium prices are notoriously unpredictable. A surge in demand can send prices soaring, but oversupply or geopolitical tensions might cause a sharp fall. Investors should be prepared for these swings, as they can significantly impact stock valuations. For instance, a price drop of just 10% can lead to disproportionate declines in a producer’s profit margins.

Environmental Concerns in Lithium Mining

Mining lithium has environmental costs, like water depletion and habitat destruction. These issues are increasingly drawing scrutiny from governments and activists. Companies with poor environmental practices risk fines, operational delays, or even shutdowns. On the flip side, firms investing in eco-friendly methods might gain a competitive edge.

Opportunities in Sustainable Lithium Production

Sustainability is becoming a major focus in the industry. Companies that adopt greener technologies, like recycling lithium from old batteries, are not only reducing costs but also appealing to socially conscious investors. Some firms are even exploring direct lithium extraction methods, which use less water and land.

Comparing Lithium Stocks to Other Sectors

Lithium vs. Semiconductor Stocks: A Comparative Analysis

Lithium stocks and semiconductor stocks both play critical roles in modern technology, but they cater to vastly different industries. While lithium is the backbone of energy storage solutions, semiconductors are the brains behind electronics.

| Feature | Lithium Stocks | Semiconductor Stocks |

|---|---|---|

| Industry Focus | Energy storage, EVs | Electronics, computing |

| Market Cycles | Commodity-driven | Innovation-driven |

| Key Risks | Price volatility | Supply chain issues |

Investors often find lithium stocks more volatile because they are tied to commodity pricing, whereas semiconductors rely heavily on technological advancements and R&D.

How Lithium Stocks Stack Up Against Renewable Energy

When comparing lithium stocks to renewable energy companies, the connection is obvious—they both support the green revolution. However, lithium stocks are more narrowly focused on battery production, while renewable energy spans solar, wind, and hydropower technologies. Here are some key differences:

- Revenue Sources: Lithium companies depend on mining and refining, whereas renewable firms generate income from energy production and infrastructure.

- Growth Drivers: Lithium demand is fueled by EVs and portable electronics. Renewable energy grows with government subsidies and global energy needs.

- Environmental Challenges: Lithium mining faces scrutiny for its environmental impact, while renewable energy is generally seen as eco-friendly.

Diversifying Portfolios with Lithium Investments

Adding lithium stocks to a portfolio can provide exposure to the booming EV and energy storage markets. Here’s why it might make sense:

- High Growth Potential: The shift toward electric vehicles and renewable energy ensures long-term demand for lithium.

- Inflation Hedge: As a commodity, lithium can serve as a hedge against inflation.

- Complement to Traditional Sectors: Lithium investments can balance portfolios heavily weighted in tech or finance.

Expert Opinions on Lithium Stocks

Insights from Industry Analysts

Industry analysts have been closely monitoring the lithium sector, and their insights often highlight the delicate balance between supply and demand. For instance, some experts believe that the rapid adoption of electric vehicles (EVs) is causing a structural shift in the market. This demand surge is expected to keep lithium prices elevated, despite short-term fluctuations. However, analysts caution that over-reliance on a few major mining companies could pose risks if production targets fall short.

Predictions for the Lithium Market

Predictions for the lithium market vary, but a common theme is its long-term growth trajectory. Analysts project that global lithium demand could double by 2030, driven by EVs, renewable energy storage, and emerging technologies. Here’s a quick snapshot of current forecasts:

| Year | Global Lithium Demand (Metric Tons) | Key Drivers |

|---|---|---|

| 2025 | 1.5 million | EVs, grid storage |

| 2030 | 3.0 million | EVs, tech advancements |

| 2040 | 5.0 million | Widespread electrification |

While the numbers are promising, analysts also point out that geopolitical tensions and environmental regulations could impact supply chains.

Investor Sentiment on Lithium Stocks

Investor sentiment toward lithium stocks has been a mixed bag lately. While some are bullish, citing strong demand and technological advancements, others remain cautious due to high valuation levels and market volatility. Here are three key factors influencing sentiment:

- Short-term price volatility: Lithium prices have seen sharp swings, making some investors wary.

- Sustainability concerns: Questions about the environmental impact of lithium mining are gaining traction.

- Growth prospects: Many investors are optimistic about the sector’s potential, especially with government incentives for green technologies.

“The lithium market is at a crossroads, offering both significant opportunities and notable risks for investors,” as one analyst aptly summarized the current state of affairs.

Wrapping It Up

When it comes to lithium stocks, there’s a lot to think about. The market is growing, but it’s not without its ups and downs. Companies like Albemarle show how cost management can make a big difference, even when prices drop. For investors, it’s all about keeping an eye on the bigger picture—demand for lithium isn’t going anywhere, especially with the rise of electric vehicles and renewable energy. But, like with any investment, it’s important to do your homework and stay informed. The lithium sector has potential, but it’s not a guaranteed win. So, take your time, weigh the risks, and make decisions that fit your goals.

FAQs

1. What is driving the demand for lithium?

The growing demand for lithium is mainly driven by its use in electric vehicle batteries, renewable energy storage, and consumer electronics.

2. Who are the key players in the lithium market?

Some of the major companies in the lithium market include Albemarle Corporation, SQM, and Livent Corporation.

3. Why are lithium prices so volatile?

Lithium prices can swing due to changes in demand, supply chain disruptions, and government regulations affecting mining operations.

4. How does 5StarsStocks.com evaluate lithium stocks?

5StarsStocks.com analyzes factors like company earnings, market trends, and growth potential to evaluate lithium stocks.

5. What are the risks of investing in lithium stocks?

Risks include market volatility, environmental concerns related to mining, and competition from alternative technologies.

6. Are lithium stocks a good long-term investment?

Lithium stocks could offer long-term growth potential due to the increasing adoption of electric vehicles and renewable energy solutions.